What is the Commission for Real Estate Agents in Florida?

Learn how commission works for real estate agents in Florida and how you can start earning ASAP with online real estate courses!

Quick Answer: The total average commission for real estate agents in Florida is around 5.59% of the purchase price. On a typical $410,000 home sale, that equals $22,919 in total commissions split between agents.

The beloved Sunshine State has no shortage of gorgeous homes and estates. It can be a lucrative place to start your real estate careerFlorida How To Become A Realtor In Florida Career Center, but how much commission can you make? The reality is that it depends on several factors, especially with recent industry changes affecting how agents are compensated.

Here's a closer look at how real estate commissions work in Florida, how much you can potentially earn, and how to get started.

Current Florida Real Estate Commission Rates

According to recent surveys of Florida agents, the average total commission for real estate agents in Florida is about 5.59% of the sale price, which is slightly above the national average of 5.57%. Considering the median Florida home price is around $410,000, the total real estate commission for a typical deal would be $22,919.

While this is how much the average seller pays in real estate agent fees, buyer's agents and listing agents don't walk away with that much from each deal. There are several reasons why.

First, the commission is always negotiable, so the seller can (and will!) try to get a lower rate. And second, the commission in a Florida real estate sale is typically split several ways — meaning you won't get it all for yourself.

How the NAR Settlement Changed Florida Real Estate Commissions

A landmark $418 million settlement against the National Association of Realtors (NAR) has fundamentally changed how real estate commissions work, with major implications for Florida agents and consumers. While many predicted dramatic changes to the industry, the reality one year later tells a different story.

What Actually Changed vs. Predictions

Despite widespread predictions about commission cuts, the average U.S. buyer's agent commission was 2.43% for homes sold in the second quarter of 2025—that's actually up from 2.38% a year earlier. Even more telling, the average combined buyer's and seller's agent commission increased from 5.32% to 5.44% in 2025, representing three straight quarters of commission increases since the settlement took effect.

New Rules for Buyer Agent Compensation

The settlement implemented two key changes that are now in effect:

Buyers now negotiate and pay their agents directly, rather than having the seller indirectly cover this cost. However, sellers are still usually the ones covering the buyer's agent fee because they recognize that shifting costs to buyers makes properties less competitive.

No Mandatory Buyer-Agent Commissions on MLS: Listing agents no longer post commission offers for buyer agents on MLS platforms. While agents can't advertise buyer's agent compensation on the Multiple Listing Service anymore, sellers are still covering these fees—they're just communicating it through other channels.

Required Written Agreements: You need a signed buyer representation agreement before touring homes now. This adds an extra step to the process but hasn't fundamentally changed transaction economics.

Why the Market Hasn't Changed as Much as Expected

The fundamental economics of real estate transactions remain intact for several practical reasons:

- Buyer Financial Constraints: Buyers already have so many expenses between the down payment, closing costs, and moving, that many simply don't have funds available to also pay for professional representation from an agent

- Seller Competition: In competitive markets, sellers who don't offer buyer's agent compensation put themselves at a disadvantage

- Proven Value: Buyer's agents save clients time and money and will continue to be essential in real estate transactions

Impact on Commission Negotiations

These changes have sparked increased competition among agents, but rather than driving rates down, the market has validated agent value. The traditional model is still what's playing out, with sellers using buyer's agent compensation as a strategic tool to attract more buyers.

For a deeper dive into how the settlement has played out nationally, check out our analysis: NAR Settlement One Year Later: What the Numbers Really ShowNational Nar Settlement One Year Later Career Center.

How Florida Real Estate Commission Splits Work

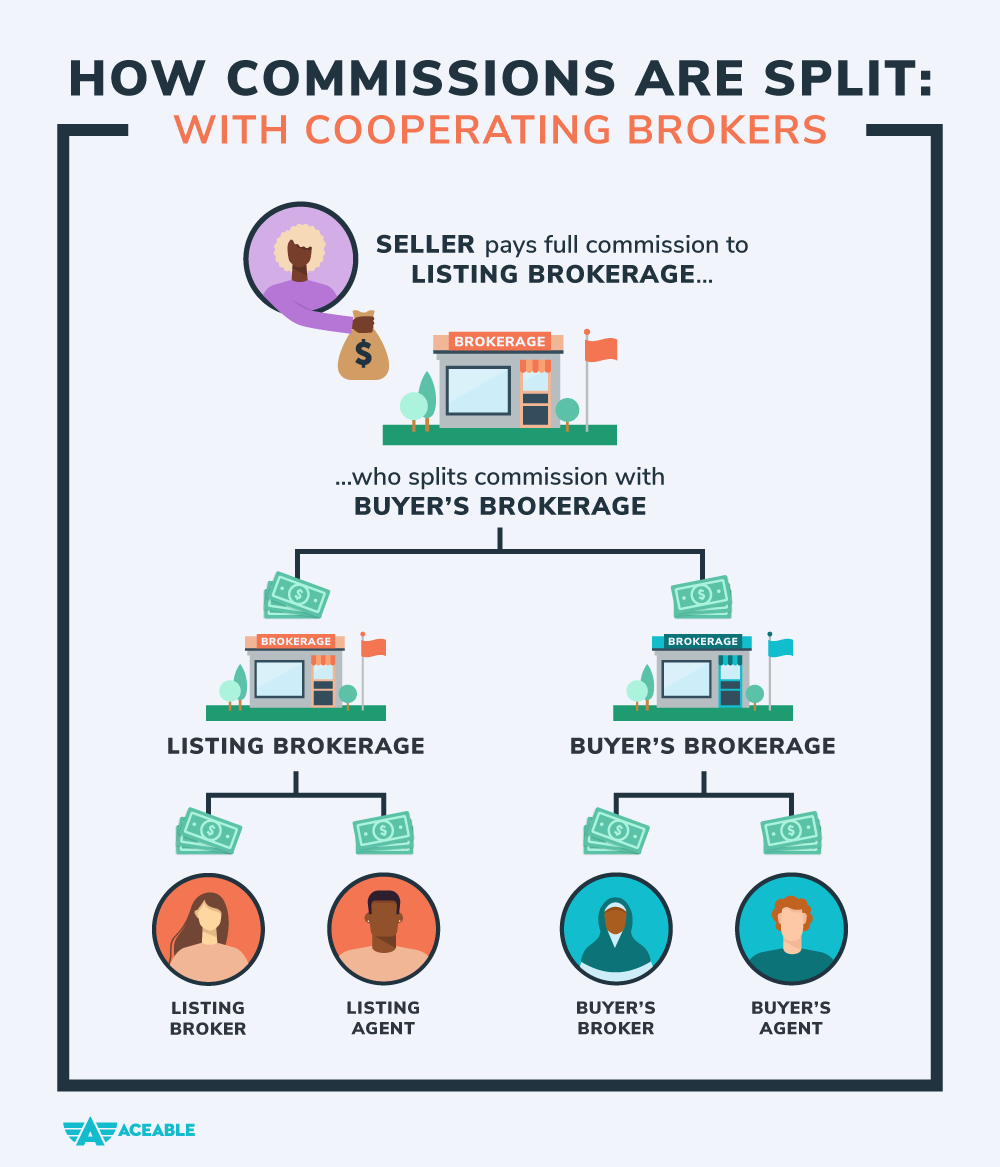

Commission checks are cut to each brokerageNational How Real Estate Brokers Get Paid Career Center at closing: the one that represents the buyer and the one that represents the seller, typically 50/50. Then, the brokerages each pay a cut to the agentsNational How Does A Real Estate Agent Get Paid Career Center based on pre-arranged fee splits.

In Florida, real estate agents must be supervised by a licensed Florida broker. And the supervising broker will always get a cut of the commissions for the homes that agents sell. A 50/50 split is common for newer agents, but you might negotiate a 60/40 split to help you keep more of the money you earn.

To recap, the commission is typically split among four people: the listing agent, the listing agent's broker, the buyer's agent, and the buyer's agent broker.

However, this structure is evolving. The NAR settlement could result in real estate commissions falling by 25% to 50% in the coming years as the industry adapts to new compensation models.

Real-World Commission Example

Let's look at an example to see how this works in practiceHow Does Commission Split Work Real Estate Agents Blog.

Using the 5.59% average commission rate, the total payout on a $410,000 sale would be around $22,919 — this is the total amount of commissions. Now, let's assume you're the buyer's agent, and you have a 60/40 split with your broker. We'll also assume the listing agent has a 60/40 split with their broker. (Which is typical.)

First, the listing brokerage and buyer's brokerage split the commission 50/50. Both sides get $11,459. Then, the listing agent's broker and the listing agent split their share 60/40. And, you (as the buyer's agent) and your broker split your share 60/40.

The commission payouts would be as follows:

- Listing agent's broker (40%): $4,584

- Listing agent (60%): $6,875

- Buying agent's broker (40%): $4,584

- Buyer's agent (60%): $6,875

Florida vs. National Average Commission Comparison

Florida's commission rates are closely aligned with national trends. The state's 5.59% average is just slightly above the national average of 5.57%, making it a fairly typical market for real estate professionals.

However, Florida's market dynamics create unique opportunities. The state's strong population growth, driven by retirees and interstate migration, combined with no state income tax, continues to fuel demand for real estate services.

Commission Negotiation Tips for Florida Sellers

Real estate commissions aren't set in stone, and there are several strategies for negotiating better rates:

Market Conditions Matter

With Florida's current market showing 6 months of supply and homes taking a median of 79 days to sell, sellers may have some negotiating power. In a seller's market, agents might be more flexible as homes sell faster.

Consider Your Property Type

Luxury properties might see lower percentage rates (4%-5%) due to their high sale price, while more challenging properties may command standard or higher rates due to increased marketing needs.

Evaluate Agent Experience and Services

Experienced agents often justify their rates with superior service, including professional photography, extensive marketing, and skilled negotiation. Less experienced agents or those offering limited services might be more negotiable.

Understanding Florida Transaction Brokers vs. Traditional Agents

Florida has a unique option called transaction brokers, who don't represent the buyer or seller in a fiduciary capacity. According to Florida statutes, unless an agent establishes a single agent or no brokerage relationship with a customer in writing, they are by default considered transaction brokers.

Transaction brokers act as facilitators rather than advocates, which can result in lower fees since they don't have the same liability and responsibility as fiduciary agents. This option provides consumers with more choice in service levels and pricing.

Understanding Different Service Models

As the real estate industry evolves, you'll encounter various service models with different commission structures. Discount brokerages offer to list homes for commission rates as low as 1-2%, which can seem attractive to cost-conscious sellers.

However, it's important to understand how different commission levels typically correlate with service levels:

Lower Commission Services Often Include:

- Basic MLS listing

- Limited marketing and advertising

- Reduced availability for showings and questions

- Less hands-on support throughout the transaction

Full-Service Commission Models Typically Provide:

- Comprehensive marketing campaigns

- Professional photography and staging advice

- Extensive availability for showings and client support

- Active negotiation and problem-solving throughout the process

The key is helping clients understand the relationship between investment and service level. Many sellers find that comprehensive marketing and dedicated support can result in higher sale prices and smoother transactions, even after accounting for higher commission costs.

As an agent, your job is to clearly communicate your value proposition and help clients choose the service level that best fits their needs and circumstances.

What Services Does Your Commission Cover?

When you pay real estate commission, you're investing in a comprehensive suite of professional services:

Marketing and Exposure

- Professional photography and virtual tours

- MLS listing with maximum exposure

- Online marketing across multiple platforms

- Print advertising and signage

- Open houses and private showings

Expert Guidance

- Market analysis and pricing strategies

- Negotiation expertise

- Contract review and management

- Coordination with inspectors, appraisers, and lenders

- Problem-solving throughout the transaction

Time and Availability

Experienced agents dedicate significant time to each transaction, often working evenings and weekends to accommodate client needs and ensure smooth closings.

Getting Started as a Florida Real Estate Agent

Are you ready to start earning commissions as a real estate agent in Florida? Before you get started, you'll want to understand how much it costsFlorida Cost To Become A Real Estate Agent In Florida Career Center to become a real estate agent.

Next, you'll need to complete the required educationFlorida Courses Required For Florida Real Estate License Career Center. The good news is that you can do it online from the comfort of your home. Once completed, you'll need to pass the state real estate exam (which you can also take online) and find a sponsoring broker. Then, you can apply for your license and get to work earning that commission.

Start Your Florida Real Estate Career

The Florida real estate commission landscape is evolving rapidly following the NAR settlement, creating both challenges and opportunities for agents and consumers. With average rates at 5.59% and new rules governing buyer agent compensation, understanding these changes is crucial for anyone involved in Florida real estate transactions.

Whether you're considering a career as a Florida real estate agent or planning to buy or sell property, staying informed about commission structures and negotiation strategies will help you make better decisions in this dynamic market.

Choose a State and Course

Learn more about being a Florida real estate agent and get exclusive offers!